Value stocks are associated with companies that appear to be undervalued by the market or are in an industry that is currently out of favor. These stocks may be priced lower than might be expected in relation to their earnings, assets, or growth potential. In an expensive market, value stocks can offer bargains. An investor who purchases a value stock typically expects the broader market to eventually recognize the company’s full potential, which might push the stock price upward.

Established companies are more likely to be considered value stocks. Older businesses may be more conservative with spending and emphasize paying dividends over reinvesting profits. The potential for solid dividend returns and more established business models tend to make value stocks less volatile. One risk is that a stock may be undervalued for reasons that cannot be easily remedied, such as legal difficulties, poor management, or tough competition.

Growth stocks are associated with companies that appear to have above-average growth potential. These companies may be on the verge of a market breakthrough or acquisition, or they might occupy a strong position in a growing industry. The recent dominance of large technology stocks is one example of this.

Growth companies may be more aggressive with spending and place more emphasis on reinvesting profits than paying dividends (although many larger growth companies do offer dividends). Investors generally hope to benefit from future capital appreciation. Growth stocks may be priced higher in relation to current earnings or assets, so investors are essentially paying a premium for growth potential. This is one reason why growth stocks are typically considered to carry higher risk than value stocks.

Different Styles for Different Times

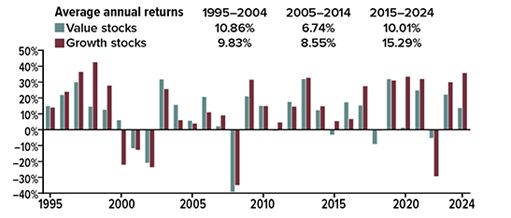

The last 20 years have been a strong period for growth stocks, but value stocks outperformed in earlier periods. Annual returns have varied widely.

Diversification and weighting

Value and growth stocks tend to perform differently under different market conditions. For diversification, it may be wise to hold both value and growth stocks in your portfolio, which can be accomplished by investing in broad index funds that generally include a mix of value and growth stocks. These are considered blended funds.

Typically, investors who follow a value or growth strategy (often called an investing style) weight their portfolios to one side or the other through funds or individual stocks. For example, let’s say you want 30% of your portfolio invested in U.S. large-cap stocks. You could hold 15% of your assets in an S&P 500 index fund and 15% in either an S&P 500 value fund or an S&P 500 growth fund. If you use a fund to emphasize value or growth in your equity portfolio, it’s important to understand the fund’s objectives and structure. Definitions of value and growth stocks differ among funds and may change over time within the same fund.

Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against loss. The return and principal value of stocks and stock funds fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. The amount of a company’s dividend can fluctuate with earnings, which are influenced by economic, market, and political events. Dividends are typically not guaranteed and could be changed or eliminated.

Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Morningstar, July 18, 2024

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2025 Broadridge Financial Solutions, Inc.